Regarding Dhanteras, the Reserve Bank of India announced that it had transferred 102 tonnes of gold from the Bank of England’s vault in London to safe locations in the country.

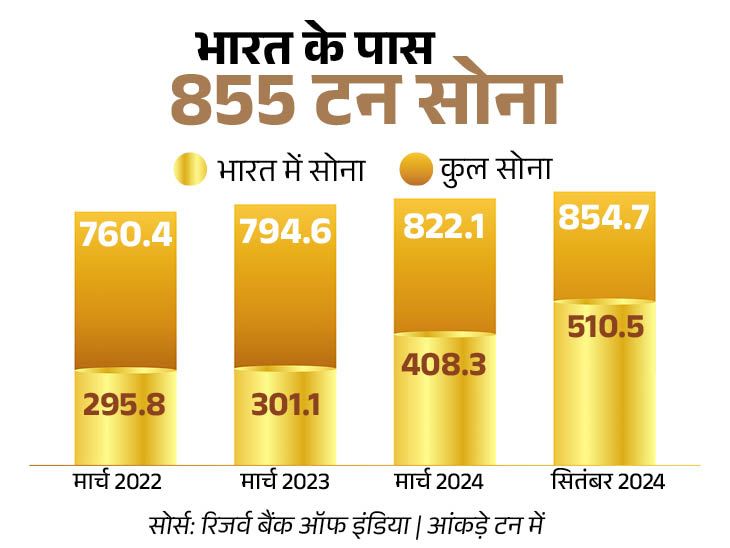

The new report on foreign exchange reserve management showed that as of end-September, of the 855 tonnes of gold held by the RBI, 510.5 tonnes were kept safe in the country.

214 tonnes of gold introduced into the country since September 2022

Since September 2022, 214 tonnes of gold have been brought into the country. The government wants to protect gold amid growing geopolitical tensions around the world. Many in the government believe it is safer to keep gold at home.

100 tonnes of gold were also imported into India in May

Earlier on May 31, a report said that 100 tonnes of gold was imported from the UK to India. India’s economic situation weakened in the early 1990s and the country had to pledge its gold. It was the first time that so much gold had returned to India.

Like last time, the RBI and the government carried out a secret mission with special planes and security arrangements to bring the gold into the country. To ensure the safety of the gold, it was kept in mind that no information of any kind was leaked.

RBI keeps gold overseas with India

RBI keeps gold not only in India but also abroad. Central banks of all countries want to keep gold in different locations to reduce risk. First of all, the safety of gold is kept in mind.

If the economic situation in India deteriorates due to disaster or political instability, gold kept abroad comes in handy to remedy the situation. Natural disasters can also cause damage to gold reserves. This risk is reduced by keeping the gold in different locations.

Britain is a gold warehouse for many central banks

Britain’s Bank of England is traditionally the gold repository of many central banks. A certain amount of gold was already stored in London before Indian independence, because before independence Britain kept Indian gold in the Bank of England. So even after independence, India kept gold in London.

Around 324 tonnes of Indian gold are in the Bank of England.

Today, 324 tonnes of gold are kept safe by the Bank of England and the Bank for International Settlements. Many countries keep their gold in the Bank of England. It is the second largest depository of gold after the Federal Reserve Bank of New York.

The UK’s bullion warehouse was built in 1697

“Bullion Warehouse” – built in 1697 and later expanded to store gold from Brazil to Australia and from California to South Africa. It contains around 4 lakh gold bars. As of September, these vaults contained approximately 5,350 tons of gold.

Gold maintains economic stability and is therefore stored

If a country’s currency weakens internationally, gold reserves help maintain that country’s purchasing power and economic stability. In 1991, when India’s economy was in decline and it no longer had dollars to import goods, it raised funds by mortgaging gold and came out of this financial crisis.

Having large reserves means that the country’s economy is strong. It also shows that the country manages its money well. In such a situation, other countries and global financial institutions trust this country more. Gold reserves are a strong asset to support the monetary value of any country.

Gold crosses ₹79,000, rises by ₹936 in a day: Silver also rises by around ₹500, it is sold at ₹98,340 per kg.

After hitting an all-time high on Dhanteras, gold hit a new high on Chhoti Diwali. Today, i.e. Wednesday, October 30, the price of 10 grams of 24 carat gold increased by Rs 936 from yesterday’s price to Rs 79,681. Yesterday, the price of gold was Rs 78,745.

At the same time, the price of silver also increased by Rs 467 and reached the price of Rs 98,340 per kg. Previously, silver was at Rs 97,873. In the same month, on October 23, silver had touched an all-time high of Rs 99,151.