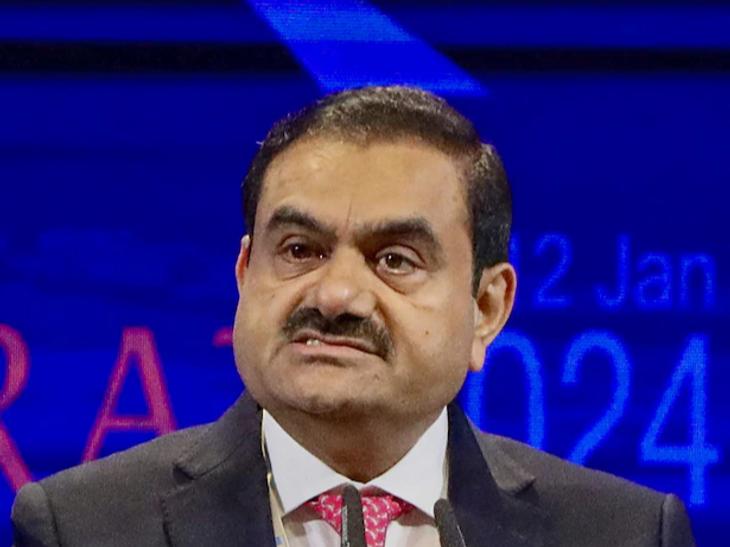

The Adani group’s difficulties could worsen in India after allegations of corruption. (File photo: Gautam Adani)

Adani Group’s problems in India could worsen after a case was registered in the US court over corruption charges. SEBI is probing whether the group violated rules relating to disclosure of market influencing information?

Meanwhile, SEBI has also sought clarification from the group. SEBI has sought answers regarding the cancellation of the airport expansion deal in Kenya and the case in America. However, the group has not yet responded.

According to sources, SEBI has also sought information from stock exchange officials. She questioned whether Adani Green Energy Limited had failed to adequately respond to the U.S. Department of Justice’s investigation into corruption allegations. The investigation into the facts can last two weeks. After this, SEBI will decide whether to initiate a formal investigation or not.

It is known that SEBI has also investigated the Adani Group over the Hindenburg Research allegations. However, he has not yet disclosed his results. Meanwhile, White House spokeswoman Karine Jean-Pierre said she was aware of the allegations against Adani. When it comes to India-America relations, the relations between the two countries are strong.

Sensex gains 1,961 points, Adani 6 out of 10 stocks in the group increased After seven weeks of decline, the national stock market saw a considerable rise on Friday. Sensex closed at 79,117 with a gain of 1,961 points (2.54%). It also achieved a gain of 2,062 points on the day. Nifty gained 557 points (2.39%) and closed at 23,907. This was the highest one-day rise after June 5, i.e. in five and a half months. With this increase, the market capitalization of BSE-listed companies increased by Rs 7.32 lakh crore (1.72%) to Rs 432.71 lakh crore.

New problem: some banks are considering stopping granting new loans. The Adani Group could face a funding shortfall early in the case in America. Credit analysts say some banks are considering temporarily banning new loans from the Adani Group. However, the group’s existing debts will remain intact. Research firm CreditSights expressed short-term concerns.

She said refinancing was the biggest concern for the group’s green energy business. Ratings agency S&P warned that the group would need regular access to equity and debt markets, but could find few buyers. Domestic and international banks and bond investors may limit their investments.

And then: fear of an impact on international investments in India On Friday, the price of Adani Ports and Special Economic Zone 2029 bonds fell $2.5 to $87.8. It fell more than $5 in two days. At the same time, long-dated bonds fell from $5 to less than 80 cents in two days. In such a situation, this matter cannot be limited to Adani.

There is a risk of widespread impact on the Indian renewable energy sector and international investments. Analyst Nimish Maheshwari said the dispute could reduce international investment in India’s renewable energy sector. Investors could demand more transparency and control, which could slow down project financing.

BJD said: agreement was with central government, Adani no Biju Jata Dal (BJD) has denied reports of a power purchase agreement with Adani Group in Odisha. The party said the 2021 deal was reached between two government agencies and not with the Adani Group. This is part of the Centre’s programme, the Manufacturing Linked Solar Scheme. This involved purchasing 500 MW of renewable energy.

America is strict about breaking the rules On the other hand, Sanjay Wadhwa, Acting Director of the US Department of Securities Enforcement, said that in cases of violations of US securities laws, we will continue to take action strict and hold them accountable.

The path to compromise has also opened: according to legal experts, an appeal can be made against the prosecutions imposed by the US Department of Justice. A legal solution as a compromise can be explored. Although it will be expensive, it can ease legal battles.

According to Shiv Sapra of Kochhar & Company, settlement payment can also take the form of a penalty. However, it would also mean an admission of wrongdoing.

Supreme Court lawyer Tushar Kumar said such a deal could help Adani avoid prolonged public scrutiny and avoid reputational damage, which would not be possible through litigation. According to US law, a settlement can be reached in a corruption case under the FCPA (Foreign Corrupt Practices Act), but there is no law in such cases in India.

————————————————– ———————————————

Adani group accused of corruption, fraud in America, SEBI to probe for violation of disclosure rules

The Securities Exchange Board of India i.e. SEBI can now investigate the Adani Group for providing wrong information and misleading investors. Market regulator SEBI will investigate whether the Adani Group violated mandatory rules on disclosure of information on market activities.