India News Get -BusinessSEBI F&O Guidelines; Updated Criteria and New Rules for Futures Options

It is around June 2024. Roshan Aggarwal is a CA based in Assam. A third year B-Tech student came to him to file his income tax return. It had suffered a loss of Rs 26 lakh in futures and options (F&O) trading in 2023-24, but had no source of income. Just a year ago, this student had suffered a loss of Rs 20 lakh.

Even the parents are not aware of this loss. The parents separated. Her mother runs a hotel business. He took out personal loans through microfinance mobile apps for futures and options trading, borrowed money from friends, and even withdrew money from his parents’ accounts without informing them .

CA said: The student was making his financial decisions under the influence of social media and his friends. One of his friends had earned Rs 1 crore from F&O trading last year. When the CA asked the student why he did not quit trading, the student replied that he had become addicted to it and could not quit it.

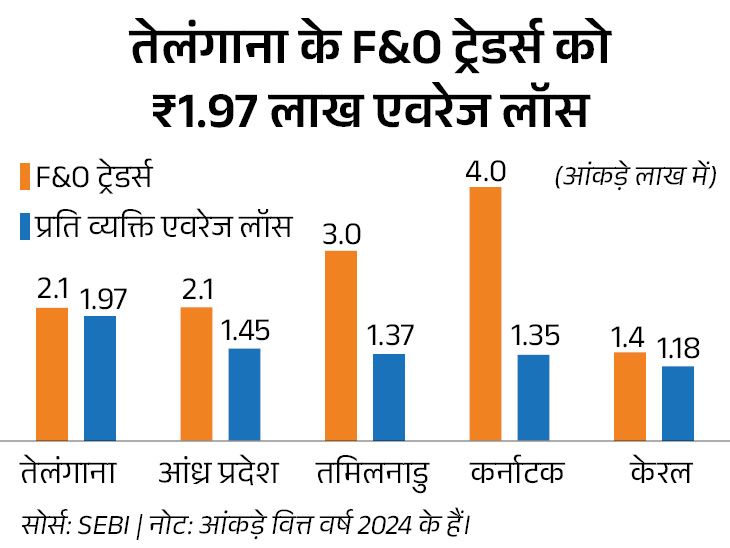

This is not just one person’s story, a recent SEBI report shows that 93%, or 93 out of 100 traders trading in the F&O segment, are in losses. Between FY 2022 and 2024, 93 lakh out of over 1 crore F&O traders lost Rs 1.8 lakh crore. The proportion of traders under 30 trading F&O increased from 31% in FY23 to 43% in FY24.

SEBI’s new circular to protect retail investors from losses, three important things…

1. Initial collection of premium from option buyers: The option premium will be collected in advance from option buyers. Most brokers already follow this rule, but those who don’t will have to do so as well. This rule will come into effect on February 1, 2025.

2. Increase in contract size for index derivatives: SEBI has increased the contract size for index futures and options from Rs 5-10 lakh to Rs 15 lakh. In other words, buyers will now have to pay more for a lot, this rule will come into force on November 20, 2024.

3. Limit expiration to one per trade: Weekly index expiration is limited to one per exchange. That is, the expiration of indices like Nifty, Bank Nifty, Nifty Financial will take place on the same day. Previously this happened on different days of the week.

Lot size of Nifty 50 increased from 25 to 75

Following market regulator SEBI’s order, the National Stock Exchange (NSE) has increased the lot sizes of its five index derivative contracts. The lot size of Nifty 50 has increased from 25 to 75, a 3x increase.

The lot size of Nifty Bank has been increased from 15 to 30. SEBI hopes that this step will reduce the participation of retail investors in F&O. The new batch sizes will be applicable from November 20, 2024.

65% to 85% of broker revenues come from F&O Stock brokers generate the bulk of their revenue from futures and options trading, approximately 65% to 85%. Recently, Nitin Kamath, founder of brokerage firm Zerodha, said that brokers’ revenues may be badly affected due to the change in regulator restricting SEBI F&O.

Demat accounts increased 4-fold between 2019 and 2024 Ten years ago, i.e. in 2014, the number of demat accounts was around 2.25 crore. In the next 5 years i.e. in 2019, this number reached 3.6 crore. But in the next 5 years i.e. from 2019 to 2024, this number increased almost 4 times to over $17 million.

However, the demat account cannot be directly linked to the number of investors. In fact, an investor can have several demat accounts. However, this gives a rough idea of the number of investors entering the market.

What are futures and options? Futures and options (F&O) contracts are a type of financial instruments that allow an investor to take large positions in stocks, commodities and currencies with less capital. Futures and options are a type of derivative contract with a fixed duration.

During this period, their prices change depending on the stock price. Futures and options on each stock are available in one lot size.

Intraday trading involves buying and selling stocks during the same trading day. Intraday trading is also called day-trading. In this, the purchase and sale of shares takes place during the same trading day. The price of stocks changes continuously during the trading day. In such a situation, intraday traders make profits on short-term stock fluctuations.