There is a decline in the stock market today i.e. Thursday January 9th. Sensex is trading at 78,000 level with a fall of around 150 points. At the same time, there is a fall of around 50 points in Nifty, it is trading at 23,650 level.

Out of 30 Sensex stocks, 5 are showing a rise and 25 are showing a fall. At the same time, out of 50 stocks of Nifty, 29 are seeing a rise and 21 a fall.

As far as NSE sectoral indices are concerned, Nifty Auto is up 0.65% and Auto is up 0.50%. While there is a decline in all other sectors. There is a decline of 0.51 for Nifty Bank, 0.53 for financial services and 0.67 for Nifty PSU stocks i.e. public sector banks.

Asian markets are mixed

In the Asian market, the Japanese Nikkei is down 0.76% and the Korean Kospi is up 0.42%. At the same time, China’s Shanghai Composite Index is trading down 0.26%. Today is the last day of the IPO of Quadrant Future Tech Limited and Capital Infra Trust InvIT. Today is the last chance for investors to invest. The shares will be listed on the BSE-NSE on January 14. According to NSE data, on January 8, foreign investors (FIIs) sold shares worth Rs 3,362.18 crore. During this period, domestic investors (DII) purchased shares worth Rs 2,716.28 crore. On January 8, the US Dow Jones closed at 42,635 with a gain of 0.25%. The S&P 500 index rose 0.16% to 5,918 while the Nasdaq index fell 0.055% to 19,478.

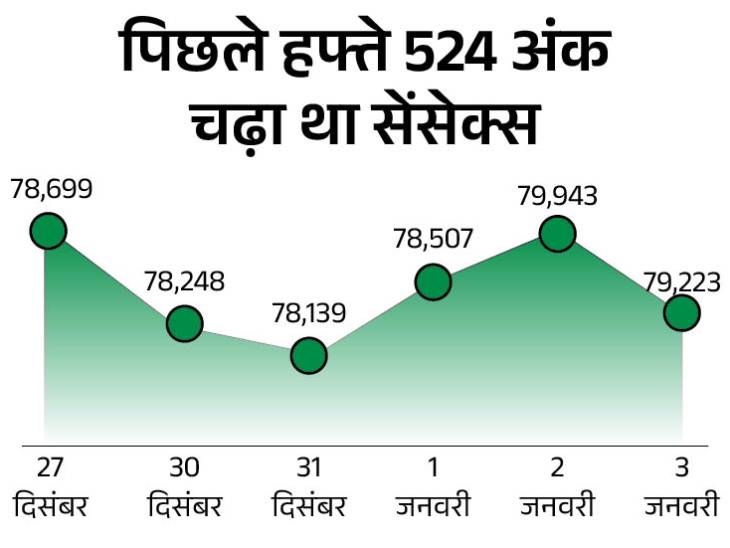

Yesterday, the stock market closed with a slight decline following fluctuations.

Yesterday i.e. January 8, the Sensex closed at the level of 78.148 with a decline of 50 points. During trade, the Sensex recovered 662 points from the day’s low of 77,486. Nifty also closed at the level of 23,688 with a rise of 18 points (-0.08%). During trade, Nifty recovered 192 points from the day’s low of 23,496.

Out of 30 Sensex stocks, 14 rose and 16 fell. At the same time, out of 50 stocks in Nifty, 22 saw a rise and 28 saw a fall. In the NSE sectoral index, the highest growth of 1.54% was seen in the oil and gas sector. While Nifty Consumer Durables closed with a maximum decline of 2.16%.